Reasons Why You Should Consider Investing in Gold

Some folks enjoy the fact that if they place their money into gold, they could physically see the investment they’ve made. If you consult many gold investors, they recommend goldco as the best platform. Others might put their cash in gold since they’re distrusting of their financial markets generally. They don’t like dealing with banks, agents, or other go-betweens when they’re investing their cash. They also worry about the purchase price and worth of the dollar over the forthcoming decades. Because of this, we see intense levels of volatility in foreign exchange markets.

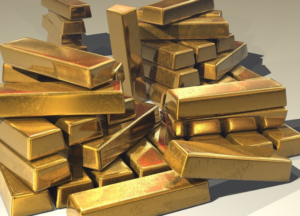

Immune to Inflation

Just like any advantage, if demand increases, the cost rises. Restricted supply and greater demand lead to higher prices for gold. Unlike in the gold rush age, when gold was available in incredible amounts, there haven’t been any new gold mines discovered in the previous ten years. That $10 on your pocket can get you $10 of products now, but in 10 years, it’ll be a whole lot less. That is inflation working. We may not be returning to the older times when we used gold to buy products and services. Still, if you feel like the wealthy and look at those reasons I have outlined, there is reliable proof that today is the opportunity to be moving a number of your investment money into gold.

High Purchasing Power

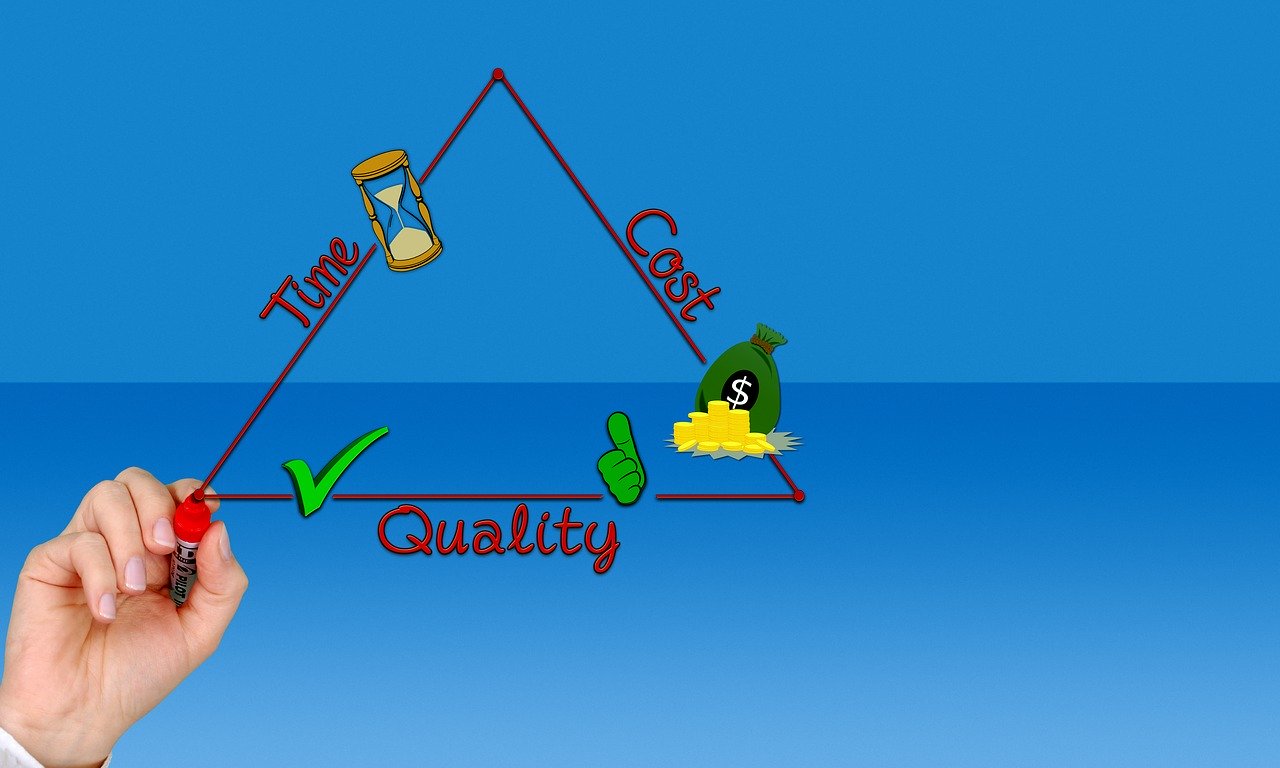

Finance gurus mention the term diversification’. In simple terms, it means do not have all of your eggs in one basket. And regardless of the stock exchange inching nearer to record highs, there’s concern that firms are finding it harder and more challenging to grow and consequently push stock prices higher. In times where stocks and property cannot create above-average returns, large financial institutions appear elsewhere to generate income. That is where gold and other priceless metals are becoming better investment options. In case the additional resources fall in value, gold climbs to offset the reduction partly.…

Your credit rating can easily ascertain what sort of card you’ll get and might even affect different factors. Therefore, if you’re seeking the best credit card depending on your credit rating, there are many alternatives available for you. Some cards can allow you to build your score.

Your credit rating can easily ascertain what sort of card you’ll get and might even affect different factors. Therefore, if you’re seeking the best credit card depending on your credit rating, there are many alternatives available for you. Some cards can allow you to build your score. This should not be your main element for obtaining a credit card, as you need to be certain it matches your other needs. Your credit rating and interest rate will affect what sort of advantages you may get.

This should not be your main element for obtaining a credit card, as you need to be certain it matches your other needs. Your credit rating and interest rate will affect what sort of advantages you may get.