Best Practices to Get Approved Fast for a Credit Repair Merchant Account

Running a credit repair company wouldn’t be possible without a proper merchant account that can always handle your clients’ payments. In today’s digital age, a credit repair merchant account is more than just a mere bank account. It is a tool that allows you to accept and process credit card payments. So, if you want to be successful in this industry, you need a reliable merchant account that will allow you to accept payments quickly and securely.

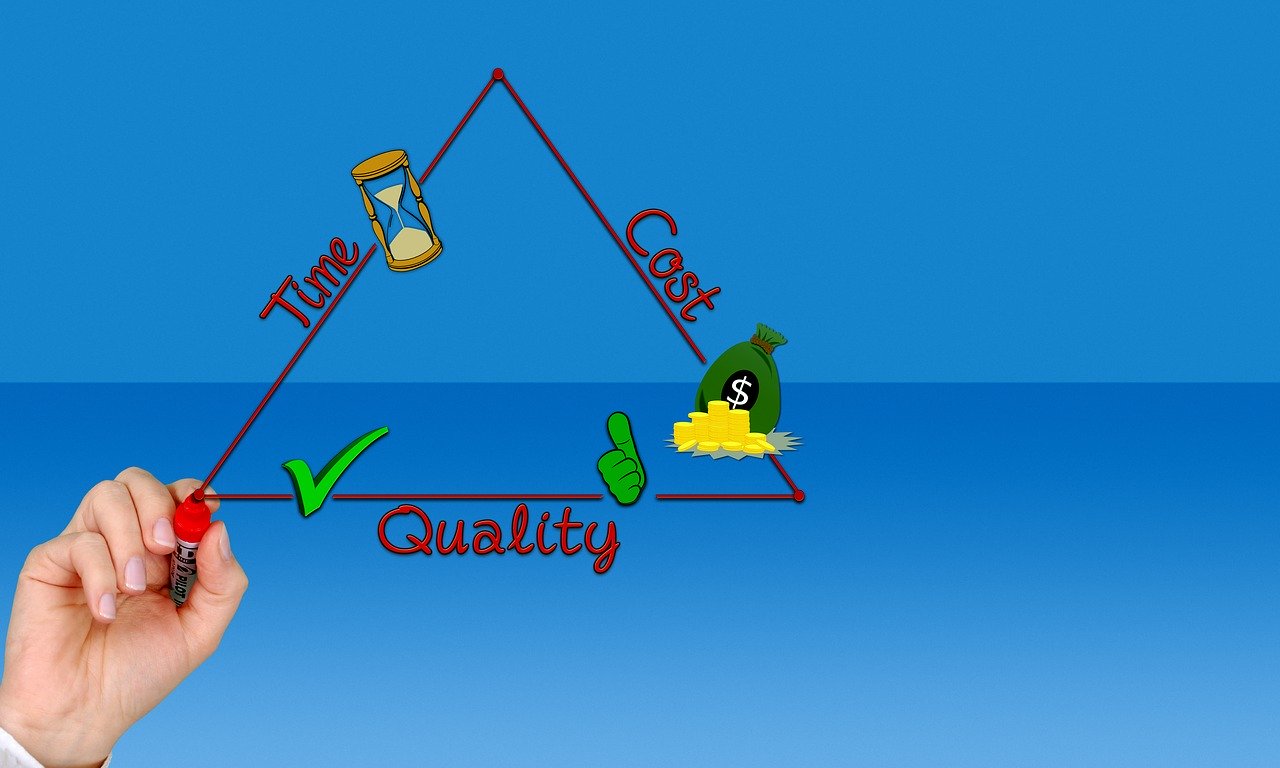

But as we all know, top Credit Repair Payment Processing and merchant account services won’t just approve any business that comes their way. They will look into your credit history, business model, and other factors to determine if you are a high-risk merchant. If they label your business as high-risk, getting approved for a merchant account within two days can be an uphill task. But don’t worry, as we’ll show you just how easy it is to improve your chances of getting approved quickly here.

Comply With All Applicable Rules or Regulations for Running Credit Repair

Just like any other fintech business, compliance is key. It’s crucial that you familiarize yourself with all the rules and regulations governing this industry in order to avoid any potential issues or setbacks. Start by thoroughly researching the legal requirements set forth by relevant, authorized regulatory bodies such as the CFPB and FTC.

Another important aspect of compliance is ensuring transparency in your operations. Clearly communicate your services, fees, and processes to clients in a way that is easy to understand. Avoid making false promises or misleading statements about what you can achieve for them.

Have a Decent Credit History

Having a decent credit history is also super crucial when it comes to getting approved fast for a credit repair merchant account. Lenders, banks, regulatory bodies, and financial institutions rely heavily on your credit history to basically assess your risk as a borrower or business owner. Therefore, it’s important to maintain a positive track record.

The key here is to keep your overall debt levels manageable and avoid maxing out your available credit. Also, if you spot any discrepancies, take immediate steps to dispute them with the appropriate authorities. Additionally, avoiding excessive inquiries into your credit can help improve your chances of approval. When you apply for too many loans or lines of credit within a short period, it could raise concerns about potential financial instability.

Lower Outstanding Debt

Aside from that, lenders and payment processors also want to see that you are managing your finances responsibly and have a good handle on your debts. So, how can you reduce that debt? To start, take a close look at all of your outstanding debts. Make a list of each creditor, the amount owed, and the total interest rates associated with each debt. Next, set up a budget that allows for regular payments towards reducing your debt. Consider reaching out to creditors directly to negotiate better terms or repayment plans if needed. Many creditors are willing to work with individuals who show genuine commitment to resolving their debts.

Consult the Professional

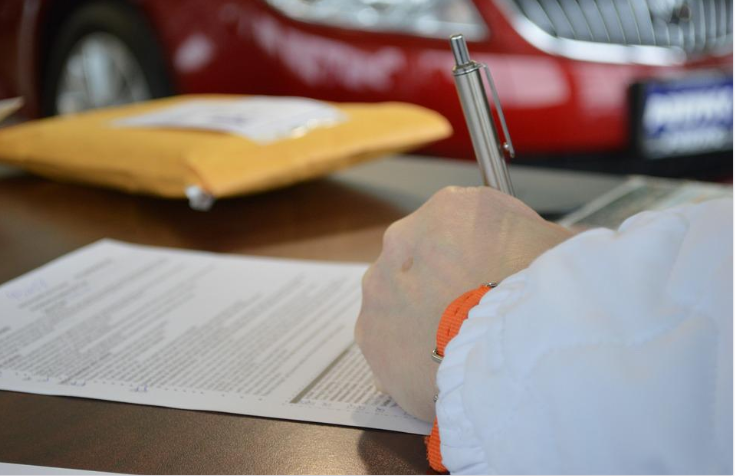

Consulting with a professional can be a game-changer when it comes to getting approved fast for a credit repair merchant account. These professionals have the knowledge and experience necessary to guide you through the application process, ensuring that all the required documentation is in order. A credit repair specialist will review your financial situation, assess any potential red flags, and provide their expertise and skills to improve your chances of approval. They can help you identify areas where you may need to make improvements, such as paying off outstanding debts or resolving any legal issues related to your credit history.

By implementing these best practices – complying with regulations, maintaining a good personal credit history, reducing outstanding debt levels, and seeking professional guidance – you are positioning yourself on the right track toward being approved quickly for a credit repair merchant account.…

Once you have disciplined spending habits and a good financial plan, it’s time to start investing. Investing allows you to grow wealth and achieve financial freedom faster than just saving alone. There are many different ways to invest, so make sure you do your research and understand the risks associated with different investments. Choose investments within your risk tolerance, and don’t invest in anything you don’t fully understand.

Once you have disciplined spending habits and a good financial plan, it’s time to start investing. Investing allows you to grow wealth and achieve financial freedom faster than just saving alone. There are many different ways to invest, so make sure you do your research and understand the risks associated with different investments. Choose investments within your risk tolerance, and don’t invest in anything you don’t fully understand. Lastly, remember that you don’t live alone in this world. Generosity and consistency are two of the most important values to live by when it comes to achieving financial freedom. Being generous and consistent with your money will help you build relationships, create opportunities and maintain a healthy lifestyle. It’s important to give back to be successful in life, financially and personally. In fact, people often fail to achieve their financial freedom since they don’t give back to others.

Lastly, remember that you don’t live alone in this world. Generosity and consistency are two of the most important values to live by when it comes to achieving financial freedom. Being generous and consistent with your money will help you build relationships, create opportunities and maintain a healthy lifestyle. It’s important to give back to be successful in life, financially and personally. In fact, people often fail to achieve their financial freedom since they don’t give back to others.

One of the most important uses for your credit score is to get approved for loans. A good credit score will help you get approved for a mortgage, personal loan, auto loan, and more.

One of the most important uses for your credit score is to get approved for loans. A good credit score will help you get approved for a mortgage, personal loan, auto loan, and more.

This means you need to figure out which bills must be paid first. This includes things like rent, mortgage, car payments, and utilities for most people. Once you’ve identified your high-priority bills, you can start thinking about budgeting your money to make sure these bills are paid. One way to do this is to create a budget for your high-priority bills. This budget should include all of the money you need to pay each bill and any additional costs associated with it.

This means you need to figure out which bills must be paid first. This includes things like rent, mortgage, car payments, and utilities for most people. Once you’ve identified your high-priority bills, you can start thinking about budgeting your money to make sure these bills are paid. One way to do this is to create a budget for your high-priority bills. This budget should include all of the money you need to pay each bill and any additional costs associated with it.

Gold is often seen as a hedge against inflation. This is because gold prices typically rise when living costs go up. When inflation goes up, the value of gold increases. This makes gold a good investment for people who are worried about inflation. Gold is also a good investment for people looking to diversify their portfolios. Gold is a scarce resource. There are only a finite amount of gold mines globally, and the demand for gold is constantly increasing. This means that the price of gold will continue to go up over time. Gold is a good investment for people looking to invest in something that is rare and has the potential to increase in value.

Gold is often seen as a hedge against inflation. This is because gold prices typically rise when living costs go up. When inflation goes up, the value of gold increases. This makes gold a good investment for people who are worried about inflation. Gold is also a good investment for people looking to diversify their portfolios. Gold is a scarce resource. There are only a finite amount of gold mines globally, and the demand for gold is constantly increasing. This means that the price of gold will continue to go up over time. Gold is a good investment for people looking to invest in something that is rare and has the potential to increase in value. Gold is also a good investment for people looking to protect their wealth. Gold is not affected by the same economic forces that other investments, such as stocks and bonds, are. This means that gold prices are not as volatile. This makes gold a good investment for people looking to protect their wealth from economic downturns. Gold is a good investment because it is a tangible asset. This means that it has a physical presence that you can hold in your hand. This is unlike stocks and bonds, which are intangible assets. Gold is also scarce, which means it is not easy to find. This makes gold a good investment for people looking to diversify their portfolios.

Gold is also a good investment for people looking to protect their wealth. Gold is not affected by the same economic forces that other investments, such as stocks and bonds, are. This means that gold prices are not as volatile. This makes gold a good investment for people looking to protect their wealth from economic downturns. Gold is a good investment because it is a tangible asset. This means that it has a physical presence that you can hold in your hand. This is unlike stocks and bonds, which are intangible assets. Gold is also scarce, which means it is not easy to find. This makes gold a good investment for people looking to diversify their portfolios.

The value of

The value of  Another great thing about gold is that you can use it to purchase goods and services worldwide. If you’re traveling or doing business in another country, you can use your gold IRA as currency. This makes it a very versatile investment option. Gold is also a good investment for people looking to protect their money during times of economic instability. If you’re looking for a safe and secure way to invest your money, investing in the best gold IRA companies is a great option. You can rest assured that your money will be protected and that you will be able to retire comfortably.…

Another great thing about gold is that you can use it to purchase goods and services worldwide. If you’re traveling or doing business in another country, you can use your gold IRA as currency. This makes it a very versatile investment option. Gold is also a good investment for people looking to protect their money during times of economic instability. If you’re looking for a safe and secure way to invest your money, investing in the best gold IRA companies is a great option. You can rest assured that your money will be protected and that you will be able to retire comfortably.…

Many third-party brokers will allow you to cash out your bitcoins in exchange for traditional currency. Since this is one of the most popular methods, we must discuss how these sites work and their advantages and disadvantages compared with other methods.

Many third-party brokers will allow you to cash out your bitcoins in exchange for traditional currency. Since this is one of the most popular methods, we must discuss how these sites work and their advantages and disadvantages compared with other methods.

Stocks, bonuses, and options are provided by many, and even some

Stocks, bonuses, and options are provided by many, and even some  Numerous testimonials are scattered throughout the net, so a trader has no reason to make a decision that he will regret. Initially, when a trader decides to dive into money trading, they might gather many feasible brokers to connect with before checking them out in reviews. Then, they can reduce the very long list of tips and names in the ads and suggestions to a dozen or three from the testimonials of forex brokers. When using reviews to gather information about brokers, it’s important to remember what you’re trying to find.

Numerous testimonials are scattered throughout the net, so a trader has no reason to make a decision that he will regret. Initially, when a trader decides to dive into money trading, they might gather many feasible brokers to connect with before checking them out in reviews. Then, they can reduce the very long list of tips and names in the ads and suggestions to a dozen or three from the testimonials of forex brokers. When using reviews to gather information about brokers, it’s important to remember what you’re trying to find.

If you find that the invoice information is not appropriate, you can talk to the seller. The Federal Revenue Commission considers it prima facie appropriate and requests it as a verification order. Whenever your assessment becomes a settlement, the transaction will be regarded as complete concerning the tax paid/deductible. Tax or income tax laws are intended to provide many justifications. The main objective is the formation of the market.

If you find that the invoice information is not appropriate, you can talk to the seller. The Federal Revenue Commission considers it prima facie appropriate and requests it as a verification order. Whenever your assessment becomes a settlement, the transaction will be regarded as complete concerning the tax paid/deductible. Tax or income tax laws are intended to provide many justifications. The main objective is the formation of the market.

The expression High-Frequency Trading (HFT) essentially means trading using the machine firmly focused on the rate of implementation. HFT systems may choose to transact an order in under a second and is used by several associations. The concept isn’t just to execute orders fast, but in large volume, so the machine can liquidate the transaction quickly. All transactions are typically closed in hours or minutes.

The expression High-Frequency Trading (HFT) essentially means trading using the machine firmly focused on the rate of implementation. HFT systems may choose to transact an order in under a second and is used by several associations. The concept isn’t just to execute orders fast, but in large volume, so the machine can liquidate the transaction quickly. All transactions are typically closed in hours or minutes.

Your credit rating can easily ascertain what sort of card you’ll get and might even affect different factors. Therefore, if you’re seeking the best credit card depending on your credit rating, there are many alternatives available for you. Some cards can allow you to build your score.

Your credit rating can easily ascertain what sort of card you’ll get and might even affect different factors. Therefore, if you’re seeking the best credit card depending on your credit rating, there are many alternatives available for you. Some cards can allow you to build your score. This should not be your main element for obtaining a credit card, as you need to be certain it matches your other needs. Your credit rating and interest rate will affect what sort of advantages you may get.

This should not be your main element for obtaining a credit card, as you need to be certain it matches your other needs. Your credit rating and interest rate will affect what sort of advantages you may get.