Simple Ways to Manage Your Financial Right

The management of your finances could be overwhelming. When you spend it wisely, money makes it grow. The more you start developing a strategy, the more likely your future is bright. Here are some steps on how to calculate net income and differentiate your monthly net income. Get ready when you put it together and figure how much you need to save to achieve your goals. Don’t forget to consider your big goals, on more than next year.

Stick on Your Budget

Limit your debt to your ability to pay it. Before you get into debt, start paying your bills. It should be used in case of disaster and should correspond to three or six months of living expenses. Focus on retirement and goals. Start smaller if you run around 10%, and you can’t earn 10%. Any number is much better than none. Do your banking for yourself or most of the services of the credit union.

Save up Money

Ensure that the tenant or homeowner includes life, disability, car, health, and health insurance. Prevention is vital. Save up, and it will never be more comfortable to enter the economy than it is today. Take advantage of your employer’s tax-privileged savings plans, including plans, or those of your bank. You will want to accept these plans because not having a cost is worse than having bad credit. Show that you can manage this debt to get a good credit rating and build your credit history.

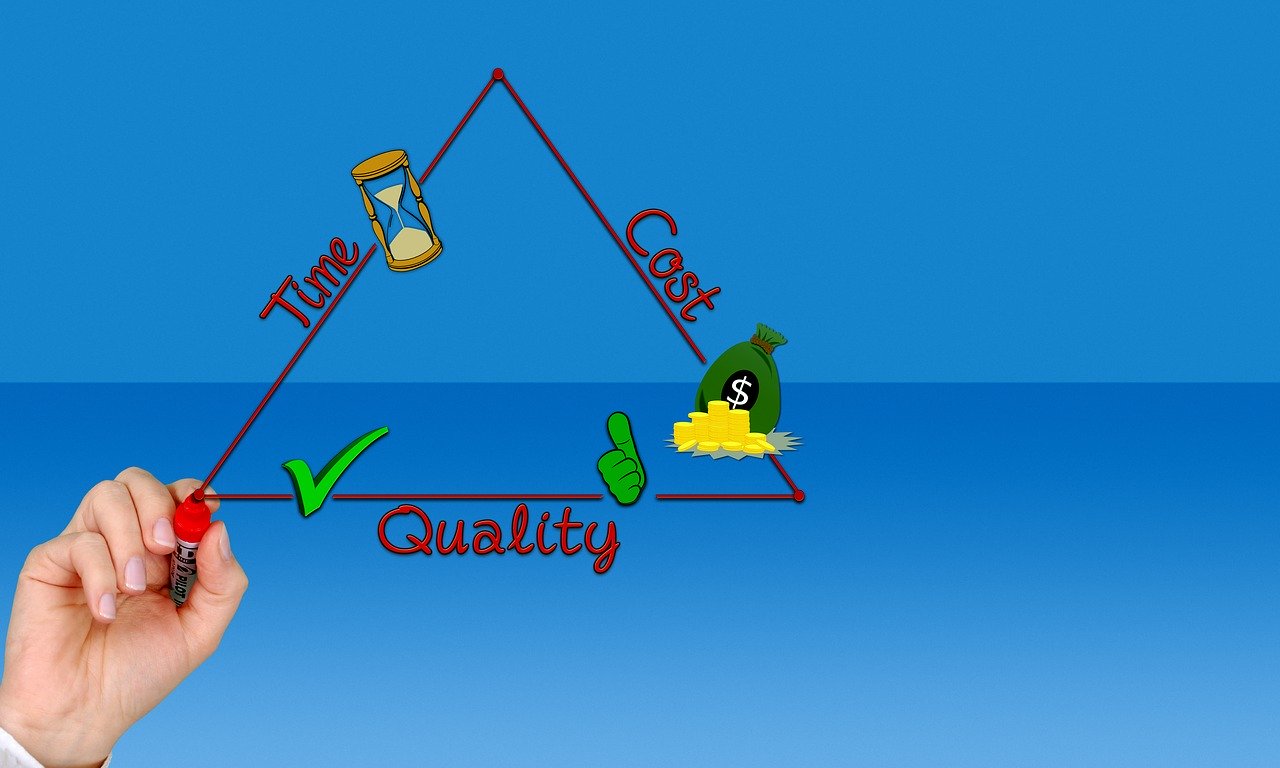

Maintain Your Goals

Write down your medium-term goals and timescales. I’m not saying you have to plan your life. If you have an idea of where you want to go in life, it will be easy for you to conclude. Write down what age you want to maintain your goals and the money that the strategy intends to pay. I think being in the position of being in life might be informing yourself that you will end up. But it does not mean that you will get a loan or a credit card, but this means that before getting into debt.

Create Your Financial Plan

Keep your professional skills clean and up-to-date. This way, your career aspirations, and any salary increases will remain open. Keep records that are relevant for tax purposes. This way, you can access them when you need them on another system. Finance’s goal should be self-explanatory. Try to get rid of your parents’ citizenship and do it yourself.

Clean up your Internet presence. Whether you need it or not, your media work is paid for by the world, your current or potential employers like everyone else. Clean up your digital action by looking for yourself on Spokeo.com or maybe pipl.com to show what is out there for people to see.…